Canton, Ohio—home of the Pro Football Hall of Fame—attracts visitors from across the country who come to celebrate America’s favorite sport. For local residents, navigating this vibrant city requires reliable transportation and appropriate insurance coverage. Understanding the options available can help Canton drivers find protection that fits both their needs and their budget.

Canton’s Unique Driving Environment

Canton presents several distinct driving considerations that impact insurance needs:

- Tourist Destination: The Pro Football Hall of Fame and other attractions bring increased traffic and out-of-town drivers unfamiliar with local roads

- Seasonal Weather Changes: Northeast Ohio experiences significant weather variations throughout the year, from summer heat to winter snow

- Urban-Rural Mix: Canton’s position provides access to both city driving and rural roads within minutes

These factors make having appropriate car insurance in Canton particularly important for residents who want to drive confidently through all seasons and conditions.

Understanding Coverage Options for Canton Drivers

While Ohio requires minimum liability coverage (25/50/25), many Canton drivers opt for more comprehensive protection. Key coverage types to consider include:

Liability Insurance

Meets Ohio’s state requirements by covering damages or injuries you may cause to others in an accident. While this satisfies legal minimums, it provides no protection for your own vehicle or medical expenses.

Collision Insurance

Pays for repairs to your vehicle after an accident, regardless of fault determination. This coverage is particularly valuable in Canton’s variable driving conditions.

Comprehensive Insurance

Protects against non-collision incidents including theft, vandalism, and weather-related damage—all relevant concerns for Canton residents who may face everything from summer hailstorms to winter ice.

Uninsured/Underinsured Motorist Coverage

Provides financial protection if you’re involved in an accident with a driver who lacks sufficient insurance—an important consideration in any area with diverse traffic patterns.

Finding Cheap Coverage in Canton

Many Canton residents are seeking ways to maintain quality coverage while managing their budgets. Several approaches can help secure cheap car insurance in Canton without sacrificing necessary protection:

Consider Alternative Business Models

Some providers operate without commissioned sales representatives, eliminating the financial incentives that often lead to unnecessary policy upselling and higher premiums.

Look for Flexible Payment Options

- Low and cheap down payments

- Custom payment plans tailored to your budget

- Ability to choose your payment date

These options can make quality insurance more accessible by aligning with your personal financial circumstances.

Value Local Expertise

Insurance providers with specific knowledge of Canton’s traffic patterns, seasonal weather challenges, and high-risk areas can often provide more appropriate coverage recommendations and potentially better rates based on accurate risk assessment.

Why Canton Drivers Need Specialized Coverage

Canton’s location and attractions create some specific insurance considerations:

- Event Traffic: Coverage that accounts for the increased congestion and accident risk during major events at the Pro Football Hall of Fame and other venues.

- Diverse Driving Environments: Protection that understands the transition between urban driving in downtown Canton and trips to nearby attractions like Gervasi Vineyard.

- Northeast Ohio Weather: Insurance that recognizes the seasonal challenges, from summer thunderstorms to winter snow and ice.

Companies like GoAuto Insurance offer Canton residents specialized coverage options designed with these local factors in mind.

Making an Informed Decision

When evaluating car insurance options in Canton, consider these factors:

- Does the provider understand Canton’s specific driving challenges?

- Are their payment structures flexible enough to meet your financial needs?

- Does the coverage adequately protect you during Canton’s popular events and seasonal weather changes?

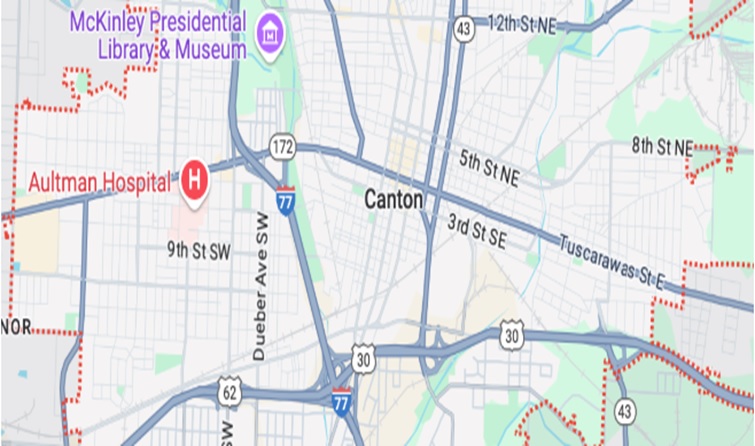

By carefully considering these elements, Canton drivers can find insurance coverage that provides both financial security and peace of mind. Whether you’re commuting to work, visiting the Pro Football Hall of Fame, or exploring the McKinley Presidential Library & Museum, proper insurance coverage ensures you can navigate Canton’s roads with confidence.